What Is Granular Loss and What Does it Mean for My Roof?

Your roof shingle consists of three primary components: the matting fiber, asphalt, and granules. Among these, granules play a crucial role in protecting the asphalt and matting from various environmental factors.

The Importance of Granules

Granules act as a shield, safeguarding the underlying asphalt and matting from the elements. They serve as a barrier against hailstorms, heavy rain, intense sunlight, and high temperatures.

Understanding Damage

When a hailstorm strikes, it can dislodge granules from your shingles, leaving the asphalt and matting vulnerable to damage. Over time, exposure to weather conditions such as heavy rain and prolonged sunlight can exacerbate this issue.

Effects of Weather

The weather poses a continuous threat to the integrity of your roof. Heavy rain can wash away granules, while excessive sunlight and heat can accelerate the deterioration of the asphalt and matting. These factors contribute to granular loss and shorten the lifespan of your shingle.

Identifying Granular

Loss One telltale sign of granular loss is the presence of bare spots or patches on your shingles where granules have been eroded. Additionally, you may notice an accumulation of granules in your gutters or around the perimeter of your home.

Preventing Granular Loss

To mitigate granular loss and extend the lifespan of your roof, proactive measures are essential. Regular roof inspections can help identify issues early on, allowing for timely repairs or replacements. Additionally, investing in high-quality shingles with durable granules can provide added protection against environmental damage.

Repairing Granular Loss

If you suspect granular loss on your roof, prompt action is crucial. Contacting a professional roofing contractor to assess the extent of the damage and recommend appropriate solutions is recommended. Depending on the severity of the granular loss, repairs may involve spot treatments or full shingle replacements.

Maintaining Your Roof

Regular maintenance is key to preserving the integrity of your roof and minimizing the risk of granular loss. Keep your gutters clean to prevent debris buildup, which can trap moisture and accelerate granule erosion. Trim overhanging branches to reduce the risk of damage from falling limbs during storms.

Conclusion

Granular loss is a common issue that can compromise the longevity and performance of your roof. By understanding its causes and effects, you can take proactive steps to protect your investment and ensure the continued safety and durability of your home. Don’t wait until the granular loss becomes a significant problem—address it promptly to maintain a sturdy and reliable roof for years to come. If you need assistance with assessing or repairing granular loss, don’t hesitate to contact A to Z Construction today for expert guidance and solutions.

What Makes A to Z Construction an Excellent Roofing Contractor?

When it comes to construction projects, ensuring customer satisfaction from A to Z is not just a motto but a commitment. At A to Z Construction, we prioritize our client’s needs and preferences throughout the entire process, setting high standards to deliver exceptional service and results.

Customer-Centric Approach

From the initial consultation to the final touches, our focus is always on the customer. We believe in putting our clients first, prioritizing their satisfaction above all else. This dedication is evident in every aspect of our work, earning us rave reviews and a stellar reputation within the industry.

Professionalism at its Best

One of the cornerstones of our success is our unwavering professionalism. Our team comprises skilled professionals with years of experience in the construction industry. Whether it’s replacing a roof or renovating a property, our experts handle every task with precision and care, ensuring the highest quality results.

Personalized Service

At A to Z Construction, we understand that every project is unique, and so are our clients’ needs. That’s why we take the time to listen and understand their requirements, tailoring our services to suit their preferences. By offering personalized solutions, we ensure that each customer receives the attention and care they deserve.

Transparent Communication

Communication is key to any successful project, and we take it seriously. From the initial planning stages to the final walkthrough, we keep our clients informed every step of the way. Whether it’s discussing timelines, budgets, or design choices, we believe in transparent communication to build trust and confidence.

Commitment to Excellence

Excellence is not just a goal; it’s a standard that we uphold in everything we do. From the quality of materials to the craftsmanship of our work, we never compromise on excellence. Our commitment to delivering superior results has earned us the trust and loyalty of our clients, making us their go-to choice for all their construction needs.

Going Above and Beyond

At A to Z Construction, we believe in going the extra mile for our clients. Whether it’s providing additional services or addressing unexpected challenges, we are always ready to go above and beyond to ensure customer satisfaction. Our dedication to exceeding expectations sets us apart and keeps our clients coming back.

Conclusion

A to Z Construction is more than just a construction company. We are dedicated partners committed to making our client’s vision a reality. With our customer-centric approach, professionalism, and commitment to excellence, we strive to exceed expectations and deliver results that truly impress. When you choose A to Z Construction, you’re not just getting a contractor; you’re getting a trusted ally from start to finish. In need of reliable construction services tailored to your needs? Contact A to Z Construction today and let our team take care of your project from start to finish.

Roof Replacement Process: What Can I Expect Before, During, and After?

Are you considering a roof replacement? Whether it’s due to wear and tear or you’re simply looking to upgrade, understanding the process is essential. In this guide, we’ll walk you through each step of the roof replacement process, from preparation to cleanup.

Preparation: Setting the Stage for Success

Before embarking on any roof replacement project, proper preparation is key. The first step in the roof replacement process is to set up a netting system around the exterior of your home. This netting system serves as a safeguard, catching any debris that may result from tearing off the old shingles and materials. By implementing this precautionary measure, you can minimize mess and ensure a smoother transition to the next phase.

Tear-Off Process: Removing the Old to Make Way for the New

With the preparatory measures in place, it’s time to tackle the tear-off process. This phase involves tearing off all the old shingles and materials from your roof. This step is crucial as it paves the way for the installation of new materials. Once the old materials have been removed, the roof is ready for the next stage of the replacement process.

Installation: Building a Strong Foundation

After completing the tear-off process, the next step is to install the new materials. This includes laying down new felt and underlayment to provide added protection and insulation. With the foundation in place, it’s time to reshingle the entire roof. This phase requires precision and attention to detail to ensure that each shingle is properly aligned and securely fastened. By investing in quality materials and expert installation, you can enhance the durability and longevity of your new roof.

Cleanup: Putting the Finishing Touches

Once the new roof has been installed, it’s time for the cleanup process. This involves removing any debris that may have accumulated during the installation process. Additionally, we perform a thorough inspection to ensure that no nails or other hazards are left behind. To further safeguard your property, we run over the yard with a magnet to detect and remove any stray nails. Our goal is to leave your property looking pristine and free of any remnants from the roof replacement.

Final Inspection: Ensuring Quality and Satisfaction

Before concluding the roof replacement process, we conduct a final inspection to verify that everything meets our stringent quality standards. We thoroughly examine the roof to check for any potential issues or areas that may require additional attention. Our team is committed to delivering exceptional results and ensuring your complete satisfaction with the completed project.

Conclusion

The roof replacement process is a multi-step endeavor that requires careful planning, attention to detail, and skilled execution. From preparation to cleanup, each phase plays a crucial role in achieving a successful outcome. By following these steps and working with experienced professionals, you can enjoy a durable, high-quality roof that enhances the beauty and value of your home. If you have any further questions or are ready to get started, don’t hesitate to contact A to Z Construction today for expert assistance and guidance.

What Is the Best Type of Roofing Underlayment for Asphalt Shingles?

When it comes to roofing, one crucial element often overlooked is the underlayment. Acting as a protective barrier between the roofing material and the decking, roofing underlayment plays a pivotal role in ensuring the longevity and durability of your roof. In this comprehensive guide, we’ll explore the significance of synthetic felt roofing underlayment and its unmatched water resistance capabilities.

Understanding Synthetic Felt: A Superior Choice

Synthetic felt, also known as roofing felt or underlayment, is a modern alternative to traditional asphalt-saturated felt. Its popularity stems from its exceptional water resistance, making it a preferred choice for roofing projects across various climates. Unlike its asphalt counterpart, synthetic felt offers higher durability and longevity, ensuring optimal protection for your roof.

The Importance of Water Resistance

One of the primary functions of roofing underlayment is to shield the decking from water infiltration. Synthetic felt excels in this aspect, providing superior water resistance compared to conventional materials. By effectively repelling water, synthetic felt prevents moisture from seeping into the decking, thereby minimizing the risk of rot, mold, and structural damage.

Enhanced Protection for Your Roof Decking

The decking serves as the foundation for your roof, providing structural support and stability. However, exposure to moisture can compromise its integrity over time. Synthetic felt acts as a reliable barrier, safeguarding the decking from the harmful effects of water intrusion. With its high water resistance properties, synthetic felt ensures that your roof remains resilient and secure against the elements.

Choosing the Right Underlayment for Your Roof

When selecting roofing underlayment, it’s essential to consider factors such as climate, roof slope, and local building codes. Synthetic felt emerges as an ideal choice for its versatility and performance in various conditions. Whether you’re installing a new roof or replacing existing underlayment, opting for synthetic felt provides peace of mind knowing that your roof is well-protected.

Installation and Maintenance Tips

Proper installation and maintenance are crucial for maximizing the effectiveness of roofing underlayment. When installing synthetic felt, ensure that it is laid out evenly and securely, with overlapping seams to prevent water penetration. Additionally, regular inspections and maintenance routines can help identify any potential issues early on, allowing for timely repairs and prolonging the lifespan of your roof.

Conclusion

Roofing underlayment, particularly synthetic felt, plays a vital role in safeguarding your roof against water damage and prolonging its lifespan. With its superior water resistance and durability, synthetic felt offers unmatched protection for your roof decking, ensuring peace of mind for years to come. When planning your next roofing project, prioritize the use of synthetic felt underlayment to secure the longevity and integrity of your roof. Contact A to Z Construction today to schedule your consultation and ensure a reliable roofing solution.

What Are the Best Roofing Materials for Severe Weather Conditions?

In the realm of home maintenance, few things are as crucial as the materials that make up your roof. The right roofing materials can mean the difference between a secure, long-lasting shelter and constant repairs due to weather damage. Today, we’ll explore some of the best roofing materials on the market, considering their durability and resilience against various elements.

Slate Roof: A Time-Tested Defender

Slate roofs stand out as one of the top contenders in the roofing material arena. When it comes to defending your home against hail storms, few options rival the robustness of slate. Its natural composition makes it adept at deflecting hail and enduring harsh weather conditions. The durability of slate ensures that your roof remains steadfast against the elements, providing reliable protection for years to come.

Metal Roofs: Longevity and Resilience

Metal roofs present another formidable option for homeowners seeking durability. While they may sustain damage under extreme circumstances, such as severe hail storms, they boast an impressive lifespan. Unlike traditional asphalt shingles, metal roofs can endure without leaking for extended periods, offering peace of mind amidst inclement weather. Their resilience against wear and tear makes them a worthy investment for homeowners looking for long-term solutions.

The Impact of Hail on Asphalt Shingles

Asphalt shingles, although common, are more susceptible to damage from hail storms. When hailstones pummel these shingles, they dislodge granules and expose the underlying asphalt to the elements. Over time, this exposure leads to deterioration, compromising the roof’s ability to repel water. In regions like Minnesota, where weather patterns fluctuate dramatically, this deterioration process can accelerate, leaving homeowners vulnerable to leaks and structural damage.

Understanding Minnesota Weather Challenges

In states like Minnesota, where residents experience a diverse range of weather conditions, the choice of roofing materials becomes paramount. The combination of sun, snow, and rain puts immense pressure on roofs, necessitating materials that can withstand such fluctuations. Opting for robust roofing materials becomes not just a matter of preference but a practical decision to safeguard your home against the elements.

Navigating Insurance Claims After Storm Damage

After enduring a hail storm, homeowners often grapple with the aftermath, including potential damage to their roofs. While some may not notice immediate leaks, the underlying issues can manifest over time, leading to costly repairs. Navigating insurance claims in the wake of such events can be challenging, with limitations on filing periods and the need for timely assessments. Homeowners need to understand their coverage and act promptly to address any storm-related damages.

Conclusion

Selecting the right roofing materials is paramount to protecting your home from the elements. Whether you opt for the enduring strength of slate, the resilience of metal, or the affordability of asphalt shingles, each choice carries implications for your home’s longevity and safety. By considering the unique challenges posed by your local climate and investing in durable materials, you can fortify your home against whatever nature throws its way. If you need guidance in making the best choice for your property, don’t hesitate to contact A to Z Construction today for expert advice and assistance.

What Are the Common Issues Found During Roof Inspection?

In the wake of severe storms, homeowners often find themselves facing unexpected challenges, one of the most common being issues found during roof inspection. These examinations, typically prompted by the aftermath of intense weather conditions, reveal a range of problems that can compromise the integrity of the roof and, consequently, the safety and comfort of the home. Let’s explore some of the prevalent issues encountered during roof inspections and their implications.

Damage to Shingles

One of the primary concerns identified during roof inspections is damage to shingles. When severe storms sweep through an area, they can wreak havoc on the roof, causing significant harm to the shingles. Among the most frequently observed forms of damage are missing shingles, a glaring indication of the force with which the storm struck. In such cases, immediate action is necessary to prevent further deterioration and potential leakage. Roofing professionals may need to employ temporary measures, such as tarping, to safeguard the affected areas and mitigate the risk of water intrusion.

Granular Loss

Another common issue detected during roof inspections is granular loss. This phenomenon occurs when the protective granules embedded in the shingles are dislodged due to the impact of severe weather. As rain, hail, or debris pummels the roof, it can strip away these granules, leaving the underlying shingles vulnerable to deterioration. The loss of granules not only compromises the aesthetic appeal of the roof but also undermines its longevity. Without adequate granular protection, the shingles are more susceptible to UV damage, moisture penetration, and premature aging, hastening the need for repairs or replacement.

Impact Damage

In addition to granular loss, roof inspections often reveal evidence of impact damage. This type of damage manifests as bruising or indentations on the surface of the shingles, indicating direct contact with external objects during a storm. Whether it’s hailstones battering the roof or debris propelled by strong winds, these impacts can leave lasting storm damage that compromise the structural integrity of the shingles. Over time, the cumulative effect of such damage can weaken the roof’s ability to withstand future storms, necessitating prompt remediation to reinforce its defenses against inclement weather.

Shortened Lifespan

One of the consequences of the aforementioned issues is the shortened lifespan of the roof. When left unchecked, damage to shingles, granular loss, and impact damage collectively contribute to the accelerated deterioration of the roof system. What was once a robust and resilient barrier against the elements becomes increasingly fragile and susceptible to further harm. As a result, the anticipated lifespan of the roof is significantly reduced, necessitating premature repairs or replacement to ensure the long-term integrity of the structure.

Preventative Measures

While issues found during roof inspection can be disconcerting, proactive measures can help mitigate their impact and preserve the structural integrity of the roof. Regular inspections, conducted by qualified roofing professionals, enable early detection of potential issues, allowing for timely intervention and preventative maintenance. By addressing minor concerns before they escalate into major problems, homeowners can prolong the lifespan of their roofs and safeguard their homes against the destructive forces of nature.

Conclusion

Issues found during roof inspection are a common consequence of severe storms and adverse weather conditions. From damage to shingles and granular loss to impact damage and shortened lifespan, these issues underscore the importance of proactive roof maintenance and timely repairs. By staying vigilant and addressing roofing issues promptly, homeowners can protect their investments and ensure the long-term durability of their homes. For expert assistance, homeowners can confidently contact A to Z Construction today.

What Are the Common Causes of Premature Roof Failure?

Is your roof showing signs of premature wear and tear? Are you experiencing unexpected leaks or missing shingles after a storm? You might be dealing with premature roof failure, a common issue that can significantly shorten the lifespan of your roof. In this guide, we’ll explore the causes of premature roof failure and discuss practical solutions to protect your home from damage.

The Impact of Hail on Roof Health

Hailstorms can wreak havoc on your roof, causing significant granular loss and damage. When hail strikes, it acts like a deep tissue massage for your roof, loosening up granules on the shingles. This granular loss weakens the integrity of the roof, making it more susceptible to further damage from rain, snow, or heavy winds.

Understanding the Effects of Wind Storms

Severe wind storms can exacerbate the problem of premature roof failure. Missing shingles, often a result of strong winds, create vulnerable spots on the roof where leaks can occur. These leaks not only compromise the structural integrity of the roof but can also lead to water damage inside your home.

Identifying Signs of Premature Roof Failure

Recognizing the early warning signs of premature roof failure is essential for taking proactive measures to address the issue. Keep an eye out for:

- Granular loss: Check your gutters and downspouts for an accumulation of granules, indicating wear and tear on your roof.

- Missing shingles: Inspect your roof after a storm for any missing or damaged shingles that may need to be replaced.

- Leaks: Look for water stains or moisture in your attic or ceilings, which could indicate a leaky roof.

- Sagging or drooping areas: If you notice any areas of your roof that appear to be sagging or drooping, it could be a sign of underlying structural damage.

Preventing Premature Roof Failure

While it’s impossible to completely eliminate the risk of premature roof failure, there are steps you can take to minimize the likelihood of damage:

- Regular maintenance: Schedule regular inspections and maintenance to identify and address potential issues before they escalate.

- Prompt repairs: Address any damage or missing shingles promptly to prevent further deterioration of the roof.

- Upgrading materials: Consider investing in high-quality roofing materials that are designed to withstand extreme weather conditions.

- Reinforcing weak spots: Reinforce vulnerable areas of your roof, such as valleys and eaves, to minimize the risk of leaks and damage.

Conclusion

Premature roof failure can pose significant challenges for homeowners, jeopardizing the integrity of their homes and incurring costly repairs. Understanding the underlying causes, such as hail and windstorm damage, is crucial in mitigating the risk of premature failure. By taking proactive measures such as regular inspections, timely repairs, and investing in quality roofing materials, homeowners can safeguard their investment and ensure the longevity of their roof. Remember, early detection and preventive maintenance are key to protecting your home from premature roof failure. If you need assistance with roof inspections or repairs, don’t hesitate to contact A to Z Construction today for reliable and professional service.

What Are the Most Popular Roof Shingle Colors in 2024?

In the realm of home design, one often overlooked yet crucial element is the color of roof shingles. While they may seem like a minor detail, the color of your roof shingles can significantly impact the overall aesthetic of your home. In 2024, as with every year, homeowners are faced with a myriad of choices when it comes to selecting the perfect hue for their roof. Let’s explore some of the prevalent trends and popular options in roof shingle colors for 2024.

The Importance of Roof Shingle Colors

Enhancing Curb Appeal

The color of your roof shingles plays a vital role in enhancing the curb appeal of your home. It can either complement or clash with the exterior color scheme, making a significant difference in the overall look and feel of your property. In 2024, homeowners are paying more attention than ever to selecting the perfect roof shingle color to elevate the visual appeal of their homes.

Reflecting Personal Style

Your choice of roof shingle color is a reflection of your style and taste. Whether you prefer classic neutrals or bold, contemporary hues, there’s a myriad of options available to suit every homeowner’s aesthetic preferences. In 2024, homeowners are increasingly opting for colors that enhance their homes’ appearance and resonate with their sense of style.

Popular Roof Shingle Colors in 2024

Stone Gray: A Timeless Choice

One of the perennial favorites among homeowners is stone gray roof shingles. This classic hue, such as the Stone Gray option from Owens Corning, offers a timeless appeal that never goes out of style. In 2024, stone gray continues to be a popular choice for its versatility and ability to complement a wide range of exterior color schemes.

Embracing Grayer Tones

While stone gray remains a staple choice, many homeowners are gravitating towards grayer tones for their roof shingles in 2024. Shades of gray, ranging from lighter hues to deeper charcoal tones, offer a modern yet understated look that pairs well with contemporary home designs. This shift towards grayer tones reflects the ongoing trend toward minimalist and monochromatic aesthetics in home design.

Bold and Dramatic: Black Shingles

In recent years, there has been a notable rise in the popularity of black roof shingles, and this trend continues to gain momentum in 2024. Black shingles, such as the Onyx Black option from Owens Corning, exude a bold and dramatic aesthetic that adds instant curb appeal to any home. Many homeowners are drawn to the sleek and sophisticated look of black shingles, particularly for newer homes with modern architectural styles.

Exploring Browner Tones

In addition to gray and black shingles, browner tones are also making a statement in 2024. Shades of brown, ranging from warm caramel hues to rich chocolate tones, offer a traditional yet inviting look that complements various home styles. Browner shingles add warmth and character to the exterior of your home, creating a welcoming atmosphere that beckons visitors inside.

Conclusion

The choice of roof shingle color is a crucial decision that can significantly impact the overall aesthetic of your home. In 2024, homeowners have a plethora of options to choose from, ranging from classic neutrals like stone gray to bold and dramatic hues like black. Whether you prefer timeless elegance or contemporary flair, there’s a perfect roof shingle color to suit every style and preference. So, as you embark on your home improvement journey, consider the latest trends and popular choices in roof shingle colors to elevate the look of your home and make a lasting impression in your neighborhood. And remember, for expert guidance and assistance, don’t hesitate to contact A to Z Construction today.

What Are the Pros and Cons of Asphalt Shingles?

In the realm of roofing materials, asphalt shingles stand out as a popular choice for homeowners seeking a balance between aesthetic appeal, cost-effectiveness, and durability. In this comprehensive guide, we’ll explore the diverse palette of colors available, delve into the pricing considerations, and weigh the pros and cons of this ubiquitous roofing option.

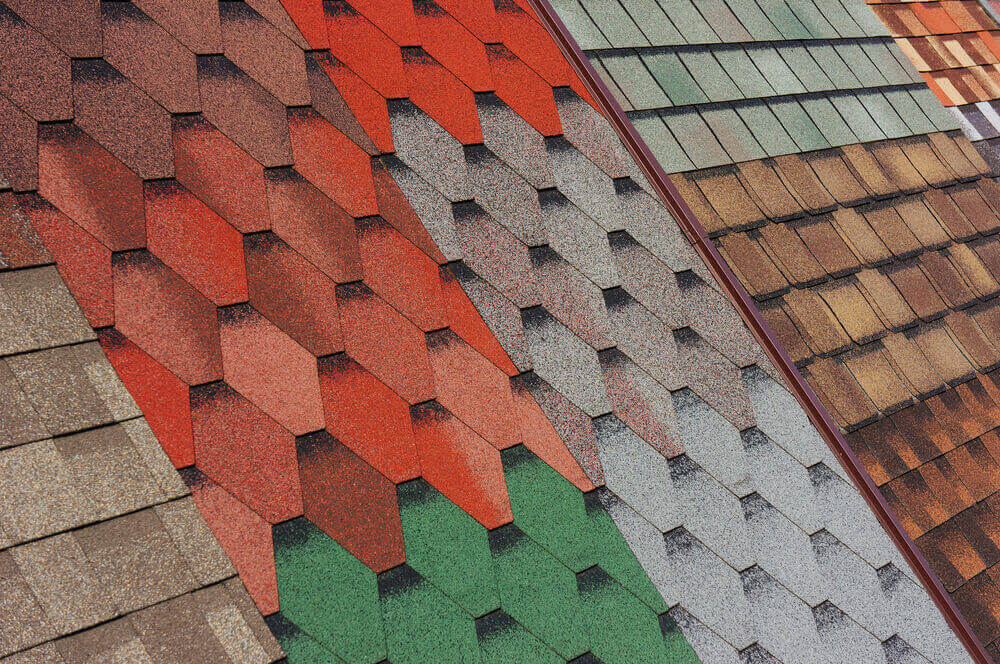

The Color Spectrum of Asphalt Shingles

When it comes to enhancing the curb appeal of your home, the color of your roofing shingles plays a crucial role. Asphalt shingles offer a myriad of color options, allowing homeowners to express their unique style preferences. From earthy tones to vibrant hues, there’s a color to complement every architectural design and personal taste.

Finding Your Perfect Shade

Whether you prefer the timeless elegance of charcoal gray, the warmth of autumn red, or the crispness of Arctic white, asphalt shingles provide a versatile canvas for your exterior design aspirations. With the ability to mimic the look of more expensive roofing materials such as wood or slate, asphalt shingles offer a cost-effective way to achieve your desired aesthetic.

Pricing Considerations: Affordability at its Core

One of the primary advantages of asphalt shingles is their affordability relative to other roofing options. Compared to metal roofs or premium materials like slate, asphalt shingles come with a significantly lower price tag, making them accessible to a wide range of homeowners.

Balancing Cost and Longevity

While asphalt shingles may be more budget-friendly upfront, it’s essential to consider their lifespan in the overall cost equation. While they may not boast the same longevity as metal or slate, asphalt shingles still offer a respectable lifespan, especially when properly maintained. However, it’s worth noting that over time, asphalt shingles may experience granule loss, which can impact their appearance and performance.

Pros and Cons: Weighing the Benefits and Drawbacks

Like any roofing material, asphalt shingles come with their own set of advantages and disadvantages. Understanding these can help you make an informed decision about whether asphalt shingles are the right choice for your home.

Pros: A Closer Look

- Variety of Colors: Asphalt shingles offer a wide array of colors to suit diverse design preferences.

- Affordability: Compared to alternatives like metal roofing, asphalt shingles are a more budget-friendly option.

Cons: Considerations to Keep in Mind

- Limited Lifespan: While cost-effective, asphalt shingles may not last as long as other roofing materials.

- Granule Loss: Over time, asphalt shingles may experience granule loss, affecting their appearance and performance.

Conclusion

Asphalt shingles present a compelling option for homeowners seeking a balance of affordability, versatility, and durability in their roofing material. With a spectrum of colors to choose from and competitive pricing, asphalt shingles offer a practical solution for protecting and enhancing your home for years to come. If you’re ready to explore your options further, don’t hesitate to contact A to Z Construction today for expert guidance and installation services.

What Should Be Included in a Roofing Estimate?

When it comes to maintaining or replacing your roof, one of the crucial steps is understanding the roofing estimate. This document outlines the scope of work and associated costs, providing valuable insights into the project. In this guide, we’ll explore the various components of a roofing estimate for your home’s roof and shed light on the essential factors that influence pricing.

The Basics of a Roofing Estimate

A roofing estimate typically includes several fundamental elements that outline the necessary materials and labor required for the project. Among these essentials are underlayment, which acts as a protective barrier between the roof deck and shingles. Synthetic felt and ice and water barriers are common types of underlayment used to enhance durability and weather resistance.

Exploring Key Components

In addition to underlayment, a roofing estimate may specify other critical components such as valleys, drip edges, and shingles. Valleys play a vital role in channeling water away from vulnerable areas of the roof, while drip edges help prevent water from seeping into the underlying structure. Shingles, available in various materials and styles, form the outermost layer of protection against the elements.

Understanding Additional Features

Beyond the basics, a roofing estimate may include various additional features and accessories to optimize performance and functionality. Turtle vents, for instance, facilitate proper attic ventilation, helping regulate temperature and moisture levels. Ridge vents serve a similar purpose, promoting air circulation to prevent moisture buildup and mold growth.

Exploring Smaller Pieces

In addition to vents, smaller pieces such as ridge caps and flashing may be specified in the roofing estimate. Ridge caps provide a finished look along the peaks of the roof, while flashing helps waterproof joints and transitions between different surfaces. These smaller components play a crucial role in ensuring the integrity and longevity of the roof system.

Factors Influencing the Estimate

Several factors can influence the cost of a roofing estimate, ranging from the size and complexity of the roof to the chosen materials and accessories. Additionally, local labor rates, market conditions, and any necessary permits or inspections may impact the overall pricing. It’s essential to consider these factors carefully when reviewing a roofing estimate to ensure an accurate assessment of the project’s cost.

Assessing Your Roof’s Needs

Before obtaining a roofing estimate, it’s advisable to assess your roof’s condition and identify any existing issues or potential areas of concern. By conducting a thorough inspection, you can provide contractors with valuable information to generate a more precise estimate. Additionally, communicating your preferences and priorities can help tailor the estimate to meet your specific needs and budget.

Conclusion

A roofing estimate serves as a valuable tool for homeowners and contractors alike, outlining the scope of work and associated costs for a roofing project. By understanding the essential components and factors that influence pricing, you can make informed decisions and ensure the success of your roofing endeavor. Whether you’re considering repairs, replacements, or upgrades, a comprehensive roofing estimate provides the clarity and confidence you need to move forward with your project. For further inquiries or to schedule a consultation, feel free to contact A to Z Construction today.